As a long-time watch collector, I’ve seen countless negotiations unfold over rare timepieces. In this comprehensive guide, I’ll share the insider techniques that separate savvy collectors from those who consistently overpay.

The Pre-Owned Watch Market: A $20 Billion Playground

The global market for pre-owned luxury watches has exploded in recent years, now estimated at over $20 billion annually. This surge has created incredible opportunities for collectors, but it’s also attracted it’s fair share of pitfalls.

Whether you’re eyeing a vintage Omega Speedmaster or a rare Patek Philippe, understanding the nuances of this market is crucial.

Knowledge: Your Most Powerful Tool

Immerse Yourself in Watch Culture

Successful negotiation starts long before you make an offer. To truly excel, you need to develop a deep understanding of horology and the current market landscape:

- Watch Forums: Engage in discussions on platforms like WatchUSeek, Rolex Forums, and Omega Forums. These communities are goldmines of information on everything from movement quirks to market trends.

- Watch Fairs: Attend events like Baselworld, SIHH (now Watches & Wonders), and regional watch shows. These gatherings provide hands-on experience with a wide range of timepieces and opportunities to network with collectors and dealers.

- Auction Houses: Follow major auction houses like Phillips, Christie’s, and Sotheby’s. Their catalogs and results offer valuable insights into the high-end market and emerging trends.

- Industry Publications: Read magazines and websites like Hodinkee, WatchTime, and Revolution. These sources often feature in-depth articles on specific models and market analysis.

Master the Details

Condition is paramount in the pre-owned watch market. A single flaw can dramatically impact a watch’s value.

Here’s what to focus on:

- Original Parts: Collectors generally prize watches with all-original components. Replacement parts, even if genuine, can decrease value.

- Patina: Natural aging of dials and hands (patina) can be highly desirable on vintage pieces. However, artificially aged components are frowned upon.

- Service History: A well-documented service history adds value and peace of mind.

- Box and Papers: Original packaging and documentation can significantly increase a watch’s worth, sometimes by 10-30%.

- Provenance: A watch’s history of ownership can add tremendous value, especially if it belonged to someone notable.

Negotiation Tactics: The Art of the Deal

The Power of Patience

One of the most potent tools in your negotiation arsenal is the willingness to walk away. I’ve seen countless collectors make poor decisions because they felt pressured to act quickly.

Remember, most vintage watches have been around for decades – a few more weeks won’t make a difference.

Patience serves multiple purposes:

- It gives you time to research thoroughly and reflect on the purchase.

- It demonstrates to the seller that you’re a serious, deliberate buyer.

- It can sometimes lead to the seller lowering their price if they’re keen to make a sale.

Creating Win-Win Scenarios

Successful negotiations result in both parties feeling satisfied. Here are some strategies to create value:

- Bundle Deals: If a seller has multiple watches you’re interested in, offer to buy several at a discounted per-watch price.

- Timing: Be aware of market cycles. Some sellers may be more motivated at the end of the month or quarter.

- Flexible Payment Terms: Offering to pay in cash or via a method that saves the seller fees can sometimes lead to a better price.

- Added Value: Instead of focusing solely on price, see if the seller can include extras like extra straps, tools, or even a service.

The Importance of Face-to-Face Interactions

While online marketplaces have revolutionized the watch trade, there’s still immense value in face-to-face negotiations when possible. Meeting in person allows you to:

- Inspect the watch thoroughly

- Build rapport with the seller

- Read body language and non-verbal cues

- Potentially discover extra pieces the seller hasn’t listed

I’ve often found that personal connections made during face-to-face deals lead to long-term relationships and future opportunities in the watch community.

Navigating Common Pitfalls

The Authenticity Minefield

With the rise of sophisticated counterfeits, verifying a watch’s authenticity has never been more crucial. Here are some steps to protect yourself:

- Research Extensively: Know the specific details of the model you’re interested in, including correct fonts, hand shapes, and movement finishing.

- Use Trusted Sources: Buy from reputable dealers or well-reviewed private sellers.

- Insist on Documentation: Always ask for the original box, papers, and service records when available.

- Consider Expert Authentication: For high-value pieces, having an independent expert examine the watch before purchase can be well worth the cost.

- Trust Your Instincts: If a deal seems too good to be true, it probably is.

The Emotion Trap

It’s easy to get emotionally attached to a watch, especially if it’s one you’ve been hunting for years. However, letting emotions drive your negotiation is a surefire way to overpay.

To avoid this:

- Set a firm budget before entering negotiations

- Have a trusted friend or advisor to ask with before making big decisions

- Be prepared to walk away if the numbers don’t make sense

Hidden Costs

The sticker price isn’t always the final cost when buying a pre-owned watch. Factor in:

- Servicing: Many vintage watches will need a service soon after purchase, which can cost hundreds or even thousands of dollars.

- Import Duties: If buying internationally, be aware of potential customs fees.

- Insurance: Valuable timepieces should be insured, adding to the overall cost of ownership.

- Authentication: For high-value pieces, the cost of expert authentication should be considered.

Adapting Your Approach

Dealing with Dealers vs. Private Sellers

Professional dealers and private sellers need different negotiation strategies:

Dealers:

- Often have less emotional attachment to pieces

- May have less flexibility on price due to overhead costs

- Usually offer some form of guarantee or return policy

- Can be valuable long-term resources for building a collection

Private Sellers:

- May have more emotional attachment to their watches

- Can sometimes be more flexible on price

- Might lack detailed knowledge about the watch

- Transactions often lack formal guarantees

Online vs. In-Person Negotiations

The rise of online marketplaces has changed the game for watch collecting. Here’s how to adapt:

Online Negotiations:

- Require clear, detailed communication

- Often involve more back-and-forth due to the lack of immediate responses

- May necessitate extra authentication steps

- Can provide access to a global market of watches

In-Person Negotiations:

- Allow for immediate inspection of the watch

- Provide opportunities to build personal connections

- Enable you to read body language and non-verbal cues

- Can sometimes lead to spontaneous discoveries or deals

Our Top Affordable Mechanical Watch for Beginners

(two options modern vs. retro)

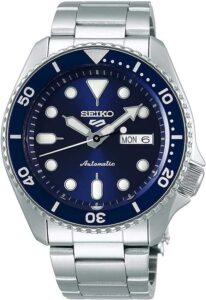

Seiko 5 Sports SRPD51

The Seiko 5 Sports line is often considered the gateway to mechanical watch collecting. The SRPD51 offers exceptional value with it’s in-house 4R36 automatic movement, 100m water resistance, and versatile dive watch design.

This watch can handle daily wear with ease and looks great on a variety of straps.

Key Features:

- In-house Seiko 4R36 automatic movement

- 100m water resistance

- Day-date display

- 41mm stainless steel case

- Unidirectional rotating bezel

Timex Marlin Hand-Wound

If you’re interested in experiencing a manual-wind movement, the Timex Marlin offers a faithful reissue of a 1960s design. It’s smaller 34mm case size is perfect for those who prefer a more vintage-inspired look.

Key Features:

- Manual-wind movement

- 30m water resistance

- 34mm stainless steel case

- Acrylic crystal for vintage appea

From Basics to Mastery

As you hone your negotiation skills, you’ll develop an intuition for value that goes beyond mere price tags. You’ll start to spot opportunities others miss, like:

- Undervalued watches from less popular brands poised for a comeback

- Rare dial variations that command a premium among collectors

- Watches with interesting provenance that adds to their value

Building Your Network

One of the most valuable assets in watch collecting is a strong network. As you engage in more transactions, focus on building relationships with:

- Reputable dealers

- Experienced collectors

- Watch repair specialists

- Auction house representatives

These connections can provide insider information on upcoming sales, rare pieces hitting the market, and valuable advice on your collecting journey.

Continuous Learning

The watch market is constantly evolving. Stay ahead of the curve by:

- Attending watchmaking workshops to understand the technical aspects

- Participating in collector meet-ups to handle a variety of timepieces

- Following auction results to track market trends

- Exploring new brands and independent watchmakers

Practical Exercises to Sharpen Your Skills

- Price Tracking: Choose a specific watch model and track it’s prices across different platforms (eBay, Chrono24, forums) for a month.

Note any patterns or discrepancies.

- Mock Negotiations: Practice your negotiation skills with friends or family.

Take turns playing the roles of buyer and seller for various scenarios.

- Condition Assessment: Visit a local watch shop and ask to examine pre-owned pieces.

Practice evaluating condition and estimating fair market values.

- Market Analysis: Pick a brand and research how it’s prices have changed over the past 5 years.

Try to identify factors that influenced these changes.

- Authentication Challenge: Find online resources for spotting counterfeit watches.

Test your skills by examining watches in person or through detailed photos.

People Also Asked

What factors affect the value of a pre-owned watch?

The value of a pre-owned watch is influenced by several factors, including brand reputation, model rarity, overall condition, presence of original box and papers, service history, and current market demand. Limited edition pieces or those with unique features often command higher prices.

How can I verify the authenticity of a vintage watch?

Verifying authenticity involves examining the watch’s details against known specifications, checking serial numbers, and potentially having it assessed by an expert. For high-value pieces, consider having it authenticated by the manufacturer or a reputable third-party service.

Are pre-owned luxury watches a good investment?

Some pre-owned luxury watches can be good investments, particularly rare or limited-edition models from prestigious brands. However, not all watches appreciate in value, and the market can be volatile.

It’s important to buy primarily for enjoyment as opposed to solely for investment purposes.

What’s the best way to negotiate price when buying a pre-owned watch?

Effective negotiation starts with thorough research on the watch’s market value. Be prepared to walk away, consider timing (end of month/quarter), and look for ways to add value beyond just price, such as including extras or offering flexible payment terms.

How often should a vintage mechanical watch be serviced?

Most experts recommend servicing a vintage mechanical watch every 3-5 years, depending on it’s age and condition. Regular servicing helps maintain accuracy and prevent wear that could lead to more expensive repairs down the line.

What’s the difference between “vintage” and “pre-owned” watches?

“Vintage” typically refers to watches that are at least 20-30 years old, often with some historical significance. “Pre-owned” simply means the watch has had a previous owner, regardless of age.

A watch can be both vintage and pre-owned.

Are there any risks in buying pre-owned watches online?

Buying pre-owned watches online carries risks such as receiving counterfeit items, watches in poorer condition than described, or dealing with unreliable sellers. Mitigate these risks by using reputable platforms, thoroughly researching the seller, and insisting on detailed photos and documentation.

What should I look for in the movement of a pre-owned mechanical watch?

When examining a pre-owned mechanical watch’s movement, look for signs of proper maintenance, such as clean surfaces and no visible rust or damage. Check for any non-original parts, as these can significantly affect value.

The movement should also run smoothly and keep accurate time.

How do I care for a vintage mechanical watch?

Caring for a vintage mechanical watch involves regular winding (if not an automatic), avoiding extreme temperatures and magnetic fields, and getting it serviced by a qualified watchmaker every 3-5 years. Avoid exposing it to water unless you’re certain of it’s water resistance capabilities.

What are some red flags to watch out for when buying pre-owned luxury watches?

Red flags include prices that seem too good to be true, sellers unwilling to provide detailed photos or information, inconsistencies in the watch’s details compared to known specifications, and signs of poor restoration work. Be cautious of watches with replaced dials or hands, as these can significantly decrease value.

Key Takeaways

- Knowledge is your most powerful tool in negotiations

- Patience often leads to better deals

- Creating value for both parties leads to successful transactions

- Always be prepared to walk away from a bad deal

- Adapt your approach based on the specific circumstances of each negotiation